Payment at the counter of a medical institution is 10% or 30% of medical expenses.

In addition, from October 1, 2022, a new burden rate of 20% will be established.

The self-pay ratio is determined on August 1st every year based on the taxable income (*Note 1) calculated from income from January 1st to December 31st of the previous year.

*Note 1: Inhabitant tax taxable income is income for calculating inhabitant tax after deducting necessary expenses and various income deductions from income. You can check the special ward tax/metropolitan tax payment notice sent from Nerima Ward (the "tax base amount" is the resident tax taxable income).

Out-of-pocket ratio

| 30% |

|

|---|---|

| 10 |

|

| 30% |

|

|---|---|

| 20% |

If there is a member of the medical system for the elderly in the same household (insured person) who has a taxable income of 280,000 yen or more and less than 1,450,000 yen, "pension income (* Note 2)" + "other total income amount" (* Note 3)” total amount is as follows

|

| 10 |

|

* Note 2: "Pension income" is the amount before deducting public pension deductions. It does not include survivor's pension or disability pension.

* Note 3: “Other total income” is the amount after deducting necessary expenses and employment income deductions from business income and salary income.

Exceptions for those born on or after January 2, 1945 and those enrolled in the medical system for the elderly aged 75 or over (insured persons) in the same household

Even if the taxable income of the inhabitant tax is 1.45 million yen or more, if the total amount of income (Note 4) on which the tax is imposed is 2.1 million yen or less, the 30% burden will not be applied.

* Note 4: The amount of income that is the basis of the assessment is the total amount of income from the previous year, the amount of forest income, and the amount of stock/long-term (short-term) transfer income, etc., and the amount of basic deduction (total income 430,000 yen if the amount is 24,000,000 yen or less). However, miscellaneous losses carried forward deductions will not be deducted.

You may be able to change from 30% copayment to 10% or 20% copayment (application for application of standard income amount)

Even if you pay 30%, if your application is approved, you will be charged 10% or 20% from the month following the application date. The conditions that can be changed are as follows.

Until now, an application was required every year to reduce the burden ratio, but from 2020, if Nerima Ward can confirm that the target person's income is less than a certain amount, the application is no longer required. rice field.

*If you cannot confirm your income in Nerima Ward, you will need to apply. We will send a document to those who are eligible to ask for the amount of income.

| Number of participants (insured persons) in the medical system for the elderly aged 75 or over |

Annual income (* Note 5) |

|---|---|

| 1 person | Those who are enrolled in the medical system for the elderly (insured) and whose annual income is less than 3,830,000 yen, or who live in the same household as the enrolled in the medical system for the elderly (insured) and are between the ages of 70 and 74 (National Health Insurance, Social Insurance, etc.) insurance policy holder) and total annual income is less than 5.2 million yen |

| 2 or more | The total annual income of members of the medical system for the elderly (insured) is less than 5.2 million yen |

* Note 5: Annual income is the total income before deducting necessary expenses and various income deductions.

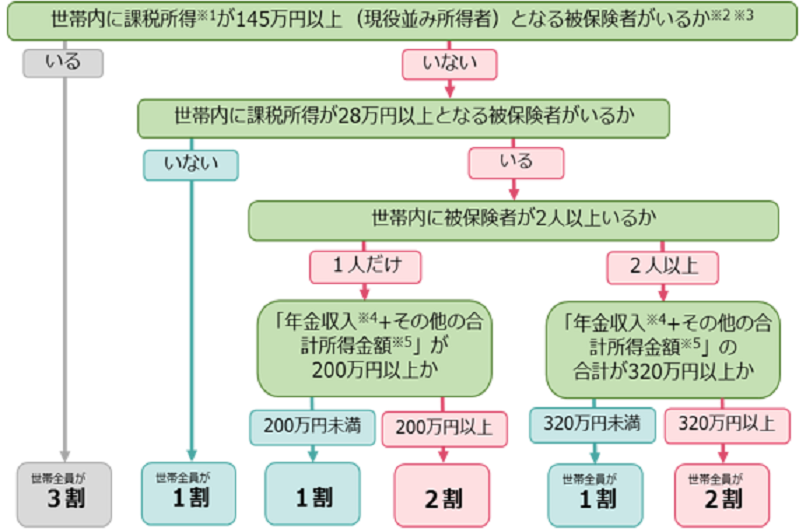

Flow of determination of self-pay ratio from October 1, 2022

Based on taxable income, pension income, etc. from January 1st to December 31st of the previous year, it is determined on a household-by-household basis.

*1 “Taxable income” refers to the amount of the “tax base” in the special ward tax/prefectural tax payment notice sent from Nerima Ward (from the previous year’s income, employment income deduction, public pension deduction, This is the amount after deducting (basic deductions, social insurance deductions, etc.).

*2 For insured persons born on or after January 2, 1945 and insured persons from the same household, even if their taxable income is 1.45 million yen or more, the amount of income on which the assessment is based (total income and If the total amount of forest income, stocks, long-term (short-term) transfer income, etc. minus the basic deduction specified by the local tax law) is 2.1 million yen or less, you will not be eligible for earning income equivalent to that of active workers. , go to "No".

*3 If your income under the Income Tax Act meets the following conditions, even if your taxable income is 1.45 million yen or more, you will not be eligible for income equivalent to that of a working person by applying for standard income, and will proceed to "No".

・If there is only one insured person: Less than 3.83 million yen

・Multiple insured persons Total income is less than 5.2 million yen *4 “Pension income” does not include surviving family pension or disability pension.

*5 “Total other income” is the amount after deducting necessary expenses and employment income deductions from business income and salary income.

Background of the review of the self-pay ratio from October 1, 2022

From 2022 onwards, baby boomers will begin to turn 75 and older, and medical expenses are expected to increase. In addition, about 40% of the medical expenses for the elderly in the later stages of life, excluding the burden paid at the counter, are borne (support money) by the working generation (children and grandchildren), and it is expected to continue to expand in the future. The revision of the self-pay ratio this time is to reduce the burden on the working generation and to connect universal health insurance to the future.

inquiry

Citizens Department, National Health Insurance and Pension Division, Senior Citizen Qualification Section

Phone: 03-5984-4587 (direct) Fax: 03-5984-1212

Send an email to this department